The year is 2014. The revolutionary pharmaceutical company Theranos, led by a confident Elizabeth Holmes, is the poster child of Silicon Valley. Claims of a machine that could perform over 200 tests on a single drop of blood brought in a seemingly endless amount of funding and interest. As they agreed to a major deal with Walgreens worth billions of dollars, Theranos’ success skyrocketed. As more investors and believers put their faith into the company, Theranos seemed unstoppable.

In the midst of Theranos’ popularity, a single scrupulous inquiry by The Wall Street Journal triggered a collapse that eliminated any possibility of the product being a success. In less than a year, a company that had previously been touted as the future of medicine quickly collapsed with its fraudulence visible to all. The eccentric figurehead behind the company, Elizabeth Holmes, was soon charged with fraud and conspiracy, her facade of being the next Steve Jobs quickly falling.

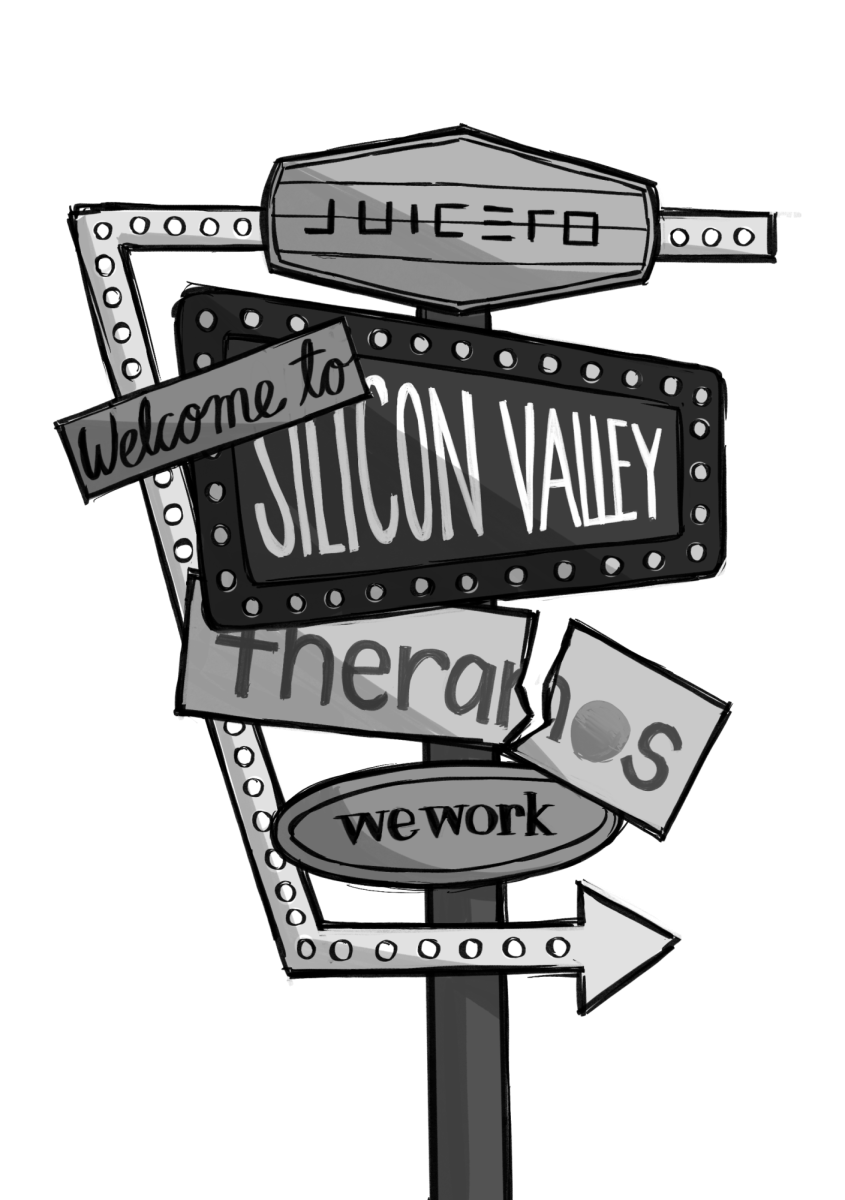

The collapse of Theranos was yet another in a series of increasingly prolific examples of the deaths of Silicon Valley startups. Companies such as Juicero and WeWork were soon to follow, emblematic of the frauds and overvaluations of companies associated with the valley of innovation.

In an area fraught with the collapses of seemingly invincible corporations running off of enthusiastic investments, more and more companies still continue to receive more capital with seemingly no due diligence or skepticism placed in their claims by regulatory agencies or investors.

Banks need to have restrictions on the riskiness of their investments restored, as well reintroduce more thorough reporting requirements for startups and mandate more transparency regarding their operations to investors and the public alike.

An industry once heavily regulated and carefully audited, banking and investments have slowly been deregulated since the 1980s. Under the Reagan administration, Congress passed a series of bills and acts that loosened restrictions on banks. A byproduct of the changes was an increased propensity for risky investment, which was now possible with fast and loose changes to the industry.

With the turn of the century, many burgeoning tech companies began to receive some of these more risky investments – in part because of the fervor surrounding the Dot Com Bubble. Companies now had an avenue of significant investment, simply through claiming they would revolutionize an industry, without having to substantiate their claims.

Much of the investment fervor was brought about by a phenomenon known as FOMO, or fear of missing out, a concern that only heightened as those who had invested early in companies such as Apple and Amazon were seeing incredible successes and high returns on investments. The belief that any technology startup could become the next Apple became prevalent, especially in the Silicon Valley area.

With each successive collapse and subsequent investigation, a lack of industry and regulation change becomes apparent. The same characteristic pitfalls that befell Theranos are ever-present in the newest “industry disruptor,” with investors still eager to provide capital all while governmental bodies turn a blind eye to the inevitable collapse.

Despite this history of overvalued companies collapsing spectacularly, investment into these companies have only grown. According to CNBC, venture capital funding exceeded over $600 billion, indicating a lack of change in the industry.

Cases such as Theranos do not only affect large investment companies but also individuals who invested and believed in their claims. The practice of exaggerating or outright fabricating claims in order to receive more venture capital is one that harms Silicon Valley as a whole.

Seeing the successes of previous companies, risky practices will continue without more regulation and oversight. The overzealous faith placed into new companies by multi-billion dollar institutions needs to be curtailed and due diligence must become commonplace again.

Failed attempts at driving innovation through a “fake-it-till-you-make-it” mentality negatively affects the public’s perception of genuine projects that seek to make a difference, the cornerstone of Silicon Valley. Each failed unicorn company drives away investment from genuine startups and tarnishes a valley once known for its propensity to deliver industry-defining innovations.

With the prevalence of unicorn startups only growing, regulation must be updated to account for the changes in how investments are made in the ever-changing Silicon Valley environment. An environment that fosters new innovation is important but should not rely on opaque and dubious claims to garner faith.